May 27, 2021

Why neurodivergent employees make excellent wealth managers

Wealth managers are master plate spinners. Their role is to effectively organize the money of affluent individuals – something that requires a broad knowledge and great variety of skills. From investment advice to estate planning to tax services and even philanthropy, good wealth managers are master strategists able to not only keep their eye on the ball, but on the pitch, the goalposts, and the other players to boot.

It’s 2021, and we all know that workplace diversity is important, yet, in broader conversations, neurodiversity is still so often overlooked. For those who don’t know, the term ‘neurodiversity’ refers to the naturally occurring variations in the brain’s neurological functions. These variations include autism, dyslexia, dyspraxia, and ADHD. Contrary to the old myth that people are “left-brained” (analytical) or “right-brained” (creative), the best wealth managers must be both analytic and creative if they want to be effective. That’s exactly why the finance industry could hugely benefit from neurodivergent talent – keep reading to find out more!

The neurodiverse advantage

Once upon a time… not so long ago… neurodiversity wasn’t fully understood. People mistook difference for weakness, or something to be wary of, and it is only in more recent years that companies have started to recognize the true power of a neurodiverse workforce. Neurodivergent individuals are often described as creative, and this is primarily because of the way they see the world; the variation in their neurological makeup can make them especially apt at spotting patterns and finding out-of-the-box solutions. It’s hardly surprising, then, that dyslexia and ADHD are overrepresented amongst entrepreneurs who are so often famed for their innovative thinking.

When it comes to the finance world, it’s important to understand that wealth managers operate within a delicate ecosystem; changes rarely happen in isolation, instead, they are a part of a complex, interconnected financial structure. Whether it’s surfing the waves of the stock market or weathering the storms of unexpected global events such as the COVID-19 pandemic, wealth managers have to be master strategists, prepared to advise their clients on the best route forward regardless of the complexity of the situation.

The reason neurodivergent individuals flourish in a role like wealth management is actually multifold. Neurodivergent people are often described as ‘big picture’ thinkers, they can think laterally and – in a finance setting – understand the interplay between the threads making up the rich tapestry of the world’s economy. It is these skills that make them great at strategy while also enabling them to spot favorable finance trends. Their tendency to see things with a bird’s-eye view means they are especially well-placed at keeping harmony across a client’s account and areas of interest.

Plus, that’s not to mention that – from a workplace culture perspective – neurodivergent individuals are much less likely to succumb to ‘groupthink’. Because of their ability to think differently, they tend to be much more comfortable calling out the status quo – a trait that is invaluable in the finance world where assessing risk is so often a huge factor.

Overcoming obstacles

So, now we know neurodivergent individuals offer great benefit to the finance world – but how can employers go about recruiting them in a fair and inclusive way? This generally requires a sensitive HR team, as it’s pivotal that a recruitment strategy doesn’t tokenize neurodivergent individuals or treat them as something alien or extraordinary. Think of neurological variation as you would any other trait or ability, it can be a desirable company asset but it doesn’t define the entirety of who that person is.

Once your HR team is informed and up to speed on the latest advice, they can take steps in publicizing their finance organization as one that is open to and supportive of neurodivergent applicants. Because of residual stigma, some neurodivergent people still feel hesitant to reveal their neurodiverse identity due to fear of discrimination – making it clear that your company is inclusive and forward-thinking can help to quash this fear from the outset.

It’s also worth thinking about your recruitment process. So often conventional recruitment tactics such as face-to-face interviews and written tasks can be inhibiting to neurodivergent applicants. Instead, consider creative means of assessment such as visual-based problem solving and even structure-building tasks (some companies even use lego!). Techniques such as these provide new ways for you to ascertain an applicant’s ability without causing undue stress to someone who has a neurological difference.

Changing the way things are done

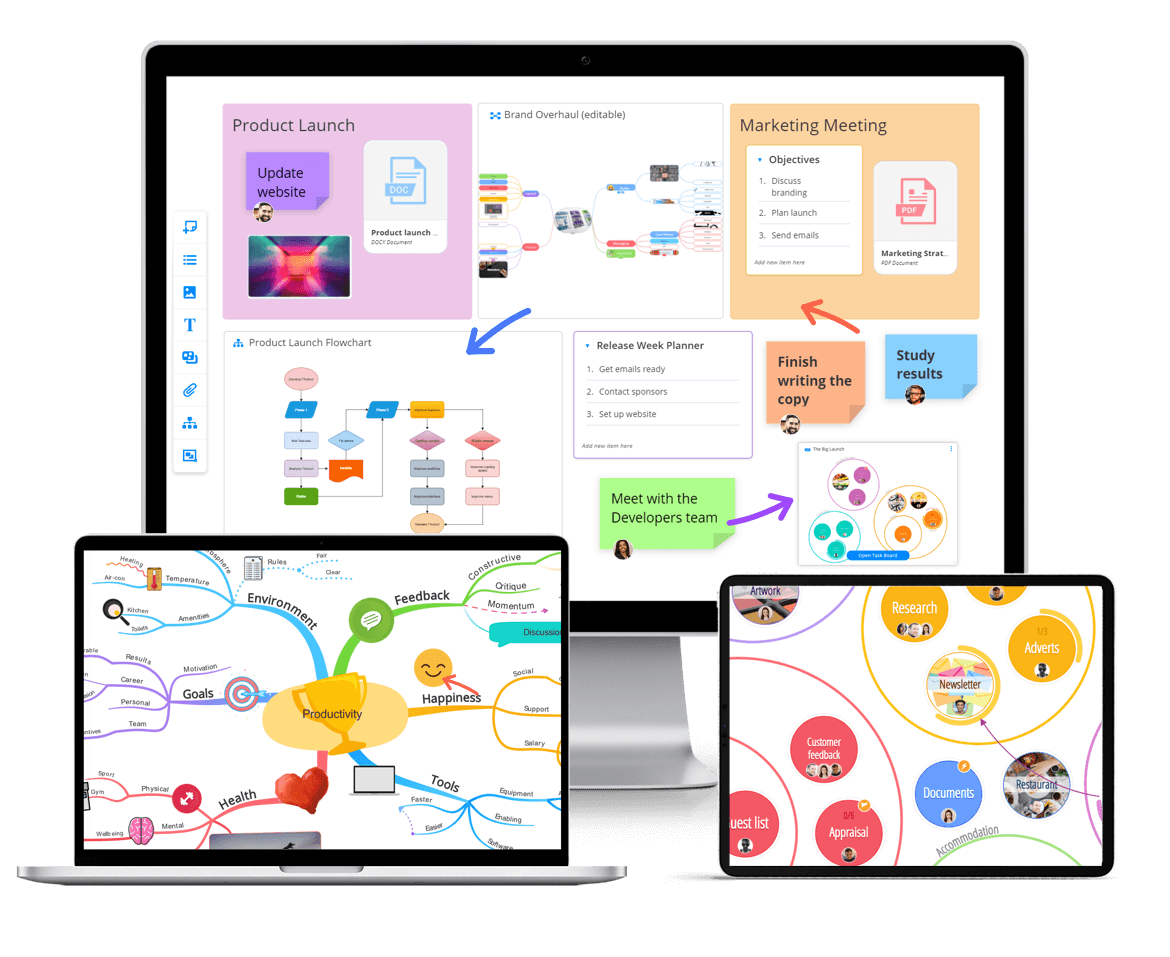

Seeking neurodiverse talent is a great thing and, like all diversity, adds to the overall success of any organization. However, it is important that support for neurodivergent individuals doesn’t end at the point of hire. From onboarding to day-to-day work, in a field such as wealth management, throwing a neurodivergent employee into a world of spreadsheets and lists is so often unconducive to maximizing that employee’s full ability. Making use of visual and creative productivity tools like Ayoa will better enable all employees – neurodivergent and neurotypical – to reach their fullest, most creative potential.

Get started with Ayoa

Ayoa allows wealth managers to seamlessly manage multiple client projects and maintain strong and engaging client relationships.

Get started for free