July 13, 2020

Why Mind Mapping will transform the 6 step wealth management process

As those within the wealth management industry will know, the process you go through with your clients to identify their financial goals and how you can assist them in bringing these to fruition involves a lot of work. These actions can range from gathering information, to maintaining regular and consistent contact with your clients.

So, how can Mind Mapping help make this process more seamless, productive and more engaging?

Mind Mapping is a powerful tool to help capture information and expand on it with ease. Using a unique combination of colors, imagery and visual-spatial awareness, Mind Maps are a truly engaging way to not only capture and explore ideas but to give your client meetings that extra edge and interaction.

Below, we’ve broken down the 6 steps of the wealth management process and how Mind Mapping can help you facilitate and transform each stage.

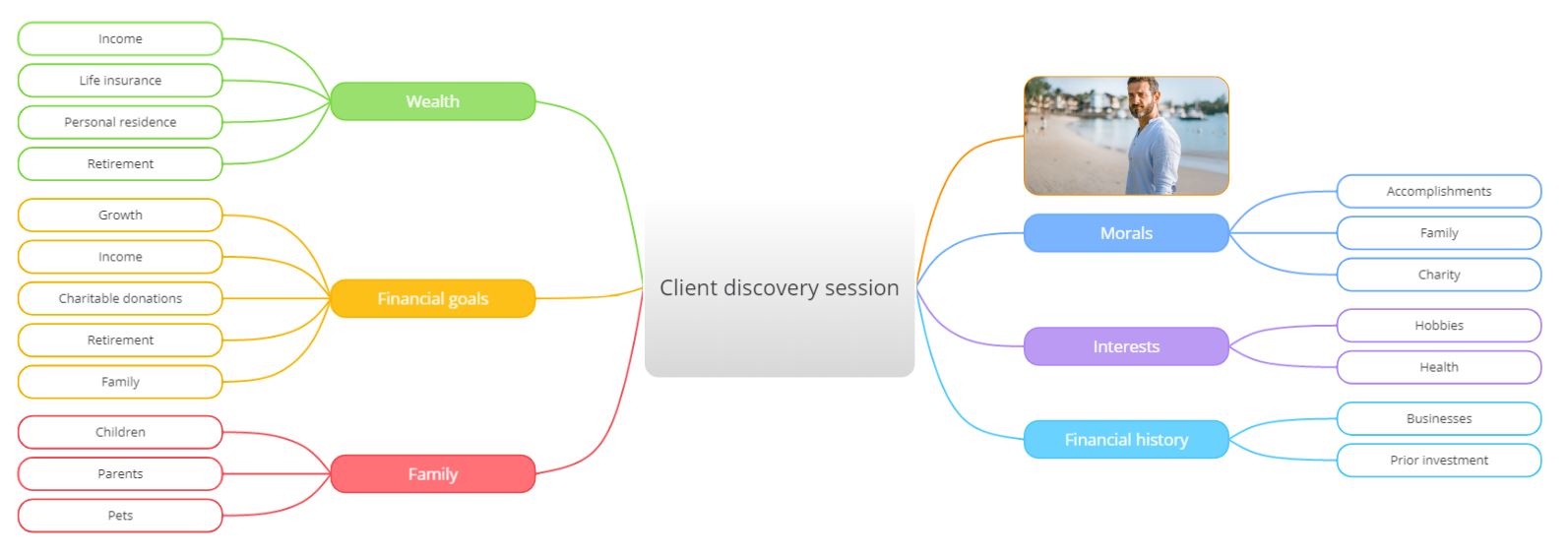

Step 1: Data gathering / client discovery

The first stage forms the basis of the entire process; gathering data and your initial client discovery session. During this session, you will typically meet with your client for around 50-60 minutes at your expense and with no obligation on your client’s part to proceed further. This is your chance to listen to what your client is looking for from a professional advisor, help them to articulate their financial goals and ask about their current arrangements. Going through this process will help you establish if you believe you can be of service to your client and deliver value for money. Here, you can also explain how you can help and the costs of your services. If you reach a mutual agreement, you can quickly move to the next stage.

How can Mind Mapping help?

This stage is arguably one of the most important, as it allows you to identify the needs of your client and understand how your services can best help to support them. Mind Mapping can be a great tool to use as part of this initial meeting. Break your meeting agenda into different branches for quick and organized note-taking, and save time jotting down notes only to forget their context long after your meeting is over. By the end of the session, you will have a Mind Map filled with all the information discussed already organized and safely stored in one place. This allows you to easily refer back to your Mind Map when needed, without having to sift through a pile of notes.

Step 2: Goal setting

If engaged with your client, the next step is goal setting. This is where you will need to gather as much information as possible about your client’s current financial arrangements, personal circumstances and their attitude to investment risks. This often involves contacting the providers of your client’s plans and policies to obtain up to date information on valuations, terms and conditions and benefits. Having a comprehensive discussion with your client will provide insight into their goals and their existing situation, helping you to tailor your financial planning process to meet their particular needs.

How can Mind Mapping help?

Mind Maps use curved branches to support and stimulate your natural thinking processes – making them the perfect tool to expand on ideas as you discuss them with your client. Try using a Mind Map to color-code related ideas and themes, so you can keep the information discussed in your meeting organized while ensuring the session is engaging for your client while you gather the information you require.

Step 3: Identification of needs

This stage involves completing an analysis of the data you gather, which will enable you to evaluate whether your resources are working the most effectively. As part of this process, you will need to examine the taxation and other implications when considering whether alterations to your client’s existing arrangements represent an appropriate strategy.

How can Mind Mapping help?

As mentioned above, Mind Maps provide a secure and dynamic space for you to capture and process detailed information. By using the branches of your Mind Map, you can easily break down complex information into specific categories, allowing you to expand on any areas that need developing.

Step 4: Report preparation

At this stage, you will be ready for a meeting with your client to start preparing your report. This meeting will provide your client with a clear view of how effectively their current arrangements are, leading them towards the financial milestones and lifestyle they wish to achieve. Your discussion will establish both the potential for making changes designed to improve the probability of achieving their goals, as well as their attitude and commitment towards making changes required.

How can Mind Mapping help?

Bringing up a Mind Map as part of your meeting will allow you to easily talk through the necessary information with your client. By using Mind Mapping software such as Ayoa, you can easily share this Mind Map directly with your client ahead of your meeting, so they have the chance to prepare for your session. This also helps to ensure that both you and your client remain on the same page, avoiding any miscommunication.

Step 5: Implementation

There are a number of steps involved in the implementation stage; however, this is where you can identify the precise details of how your client’s arrangements could be better organized to achieve their stated goals. At this stage, you will meet with your client to present and discuss your advice and agree any actions your client wishes to take. You will then be able to arrange all necessary steps to ensure their decisions are implemented thoroughly, accurately and in a timely fashion.

How can Mind Mapping help?

We’ve discussed how Mind Mapping is a powerful way of generating and expanding on ideas. However, Mind Mapping tools such as Ayoa also make it easier for you to turn these ideas into post-meeting actions. By selecting an idea or piece of information on one of the branches of your map, you can turn this directly into a task in the app which you can then assign to the relevant person to action. These tasks include a variety of use task management features, from Due Dates and Progress Indicators to Notes and Checklists. This helps everyone to clearly understand their responsibilities and actions that will be taken forward after the meeting.

Step 6: Review and revision

Although this is the final step of the process, the financial planning process is by all means not a “one-off” event. Regular review meetings are vital for you and your client to keep each other up to date with developments and other factors influencing the progress and performance of your plans. In between meetings, your client should have access to your team whenever they have any queries. You should also be sure to make contact if you have any news or fresh ideas relevant to your client’s strategy.

How can Mind Mapping help?

Ultimately, you want the process with your client to be rewarding – with so many details to decipher and analyse, it can be easy to get bogged down in a wealth of information. Mind Mapping helps to make the process more engaging, productive and efficient – so, at every stage that you meet with your client, you are both kept informed and have access to the information and ideas you create together in one dynamic space.

Looking to take your client meetings and wealth management processes to new, creative heights? Discover more about how Mind Mapping in Ayoa can help optimize your client discovery and financial planning processes and sign up for FREE today.